|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Iowa: Important Considerations

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' is a legal process that provides relief to individuals overwhelmed by debt. In Iowa, the process involves the liquidation of assets to repay creditors. This article explores the essential aspects of filing for Chapter 7 bankruptcy in Iowa, offering insights into the process and its implications.

Eligibility Criteria for Chapter 7 Bankruptcy

Before filing for Chapter 7 bankruptcy in Iowa, individuals must meet specific eligibility criteria. Understanding these requirements is crucial for a successful filing.

Means Test

The means test determines whether an individual's income is low enough to qualify for Chapter 7 bankruptcy. This test compares the debtor's average monthly income to the median income of a similar household in Iowa.

Credit Counseling

Prospective filers must complete a credit counseling course from an approved agency within 180 days before filing. This requirement ensures that individuals are aware of their financial options and the consequences of bankruptcy.

The Filing Process

Filing for Chapter 7 bankruptcy in Iowa involves several steps. Understanding each step can help individuals prepare effectively.

- Gathering Financial Documents: Collect all necessary financial documents, including tax returns, pay stubs, and bank statements.

- Filing the Petition: Submit a petition and other required forms to the bankruptcy court, detailing debts, assets, and financial transactions.

- Automatic Stay: Once the petition is filed, an automatic stay halts most collection activities, offering temporary relief.

- Meeting of Creditors: Attend a meeting with creditors, known as a 341 meeting, to answer questions about financial affairs and the bankruptcy filing.

For those interested in understanding how this process compares to other states, such as chapter 7 bankruptcy pa, reviewing local differences can be enlightening.

Exemptions in Iowa

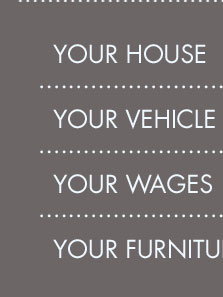

Exemptions allow individuals to keep certain property even after filing for Chapter 7 bankruptcy. Iowa has specific exemption laws that differ from federal exemptions.

Homestead Exemption

In Iowa, the homestead exemption protects a debtor's primary residence, offering significant security to homeowners during bankruptcy proceedings.

Personal Property Exemptions

Items such as clothing, household goods, and tools of the trade may be exempt up to certain limits, ensuring individuals can maintain a basic standard of living.

Frequently Asked Questions

-

What debts are discharged in Chapter 7 bankruptcy?

Chapter 7 bankruptcy can discharge unsecured debts such as credit card debt, medical bills, and personal loans. However, certain debts like student loans, child support, and taxes are typically not dischargeable.

-

How long does Chapter 7 bankruptcy take in Iowa?

The Chapter 7 bankruptcy process in Iowa usually takes about four to six months from the filing date to discharge. The timeline can vary based on individual circumstances and court schedules.

-

Will filing for Chapter 7 bankruptcy stop foreclosure?

Filing for Chapter 7 bankruptcy triggers an automatic stay that temporarily halts foreclosure proceedings. However, this may not provide a permanent solution to foreclosure if the mortgage remains unpaid.

Exploring other states' processes, such as chapter 7 bankruptcy michigan, can provide additional context and understanding of regional differences in bankruptcy laws.

Conclusion

Filing for Chapter 7 bankruptcy in Iowa is a significant decision with long-term financial implications. Understanding the eligibility criteria, filing process, and available exemptions is crucial for individuals considering this option. Consulting with a qualified bankruptcy attorney can provide personalized guidance tailored to specific financial situations.

Chapter 7 bankruptcy is the most common type of bankruptcy and involves discharge of most unsecured debts. Discharge of a debt means that the debtor no longer ...

If you are an individual person (or married filing jointly) you qualify to file a Chapter seven bankruptcy in Iowa. Chapter 7 is a type of personal bankruptcy, ...

Iowa allows up to $7,000 of equity to be exempt from the bankruptcy proceedings. For example, if you have a loan on a vehicle worth $10,000 ...

![]()